Give Today. Shape Tomorrow.

This summer, hundreds of children across Western North Carolina are discovering new friendships, building confidence, and learning life skills at YMCA summer camps. For many, it’s their first time paddling a canoe, singing around a campfire, or simply feeling like they belong.

Your support makes that possible.

As summer winds down, your gift helps us do even more—ensuring every child starts the school year strong.

Why give now?

- Camp Scholarships: 1 in 3 campers attends with the help of financial assistance.

- Back-to-School Support: We’re helping families access healthy meals, afterschool care, and resources to ease the transition into the school year.

- Safe Spaces Year-Round: Your donation supports programs that keep kids learning, active, and connected—long after summer ends.

Together, we can give every child the chance to thrive—this summer, this fall, and beyond.

Interested in donating by mail? Make the check payable to YMCA of Western North Carolina and send it to 40 N. Merrimon Ave., Suite 309, Asheville, NC 28804.

Scroll down to see other ways of giving, including stock and Qualified Charitable Distributions from your IRA.

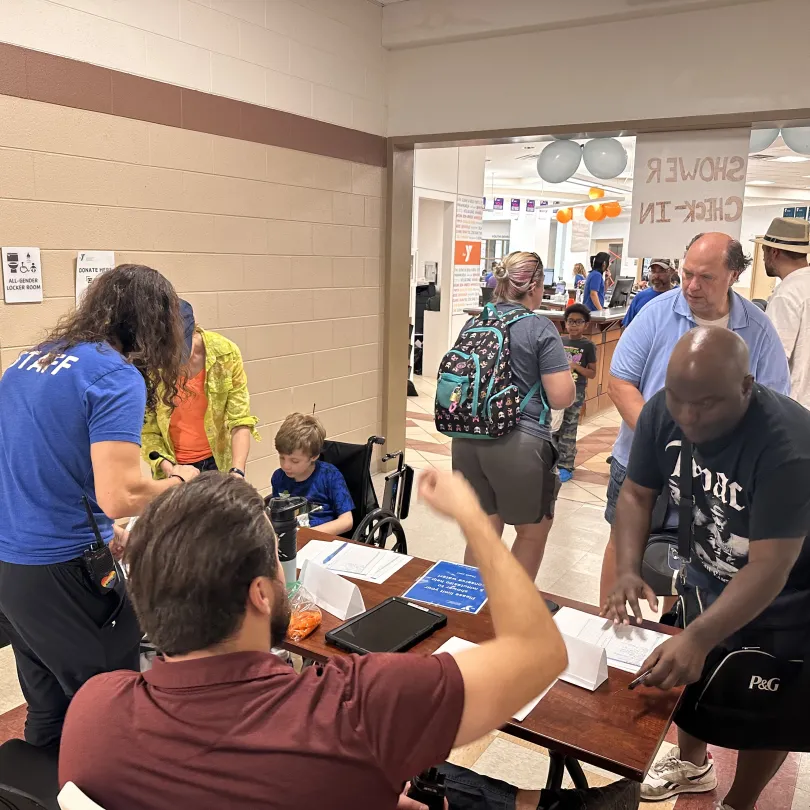

Rebuilding Community

Ways to Give

We can put your gift to work immediately when you give online.

Give now

To donate by mail, make your check payable to YMCA of Western North Carolina and send it to 40 N. Merrimon Ave., Suite 309, Asheville, NC 28804-1368.

You can support our mission through your donor-advised fund by directing gifts to the YMCA of Western North Carolina. Ask your financial planner how, or contact us for guidance.

Thousands of employers match current and past employee contributions to the YMCA. This can double and sometimes triple the impact of every dollar donated! Ask your employer if they have a matching gift program, or sign up for workplace giving.

If you are 70 1/2 years old or older, you can make a gift to the YMCA directly from your individual retirement account (IRA) without having to pay income taxes on the money. This popular gift option is commonly called an IRA Charitable Rollover, but you may also see it referred to as a Qualified Charitable Distribution (QCD).

To make a gift through your IRA, please refer to our organization as:

- The Young Men’s Christian Association of Western North Carolina, 40 N. Merrimon Ave., Suite 309, Asheville, NC 28804-1368

- Tax ID number: 56-0530013

Click here to download a sample letter for you to send to your plan administrator.

More information

If you have any questions about using your IRA to support our mission, please contact us.

Donating appreciated securities is a wonderful way to help support your community. The Y’s policy is to sell the stock or security and put the proceeds to work locally. Per the IRS, the YMCA establishes the value of the stock by calculating the mean average price on the date ownership is transferred. Many donors also choose to calculate their tax deduction this way using a receipt from the Y that notes the name and number of shares, the date they were received into Y’s account, and the high and low values per share on the date the securities were transferred.

Before making a gift of securities, please make sure to discuss your particular situation, including tax benefits, with your financial advisor. Click here for instructions on securities transfers. Please contact us if you need more information.

Please note: The YMCA does not receive donor information along with your gift of securities. It is important that you notify us in advance of any transfer using this form so that you will be credited for your gift.

Did you know there are creative ways to support the YMCA that cost you nothing right now? Whether you’re interested in a simple gift through your retirement or life insurance plan, a traditional bequest through your will or trust, or perhaps a gift that pays you back like a charitable gift annuity, there are many ways to make a legacy gift. Explore how you can include us in your estate plans.

The YMCA of Western North Carolina is a 501(c)(3) nonprofit organization that demonstrates a commitment to fiscal transparency and strong financial stewardship. All gifts are considered tax-deductible to the extent allowed by law. Our Tax ID number is 56-0530013. For a copy of our IRS designation letter or information about our accountability, please contact us.

Volunteering for the YMCA is a rewarding way to share your time and talent with your community. Whether you mentor a child, coach a team, serve a meal, or join a board, you can make a positive difference in someone's life. Explore our volunteer opportunities and find your passion at the Y.

Volunteer

If you have any questions about your recurring gift or would like to discuss cancellation options, please feel free to reach out. Our team is here to assist with any concerns you may have. Simply email us at [email protected] and we will respond as quickly as possible.